- How do you find the optimal capital structure?

- How optimum capital structure has an impact on the valuation of a firm?

- Which of the following is irrelevant for optimal capital structure?

- What are the factors that influence optimal capital structure?

- What should be the optimal capital structure for a company?

- Is it possible to increase shareholder wealth by changing the capital structure?

- Which is the best way to calculate the optimal capital structure?

- Why is optimization of capital structure an important decision?

How do you find the optimal capital structure?

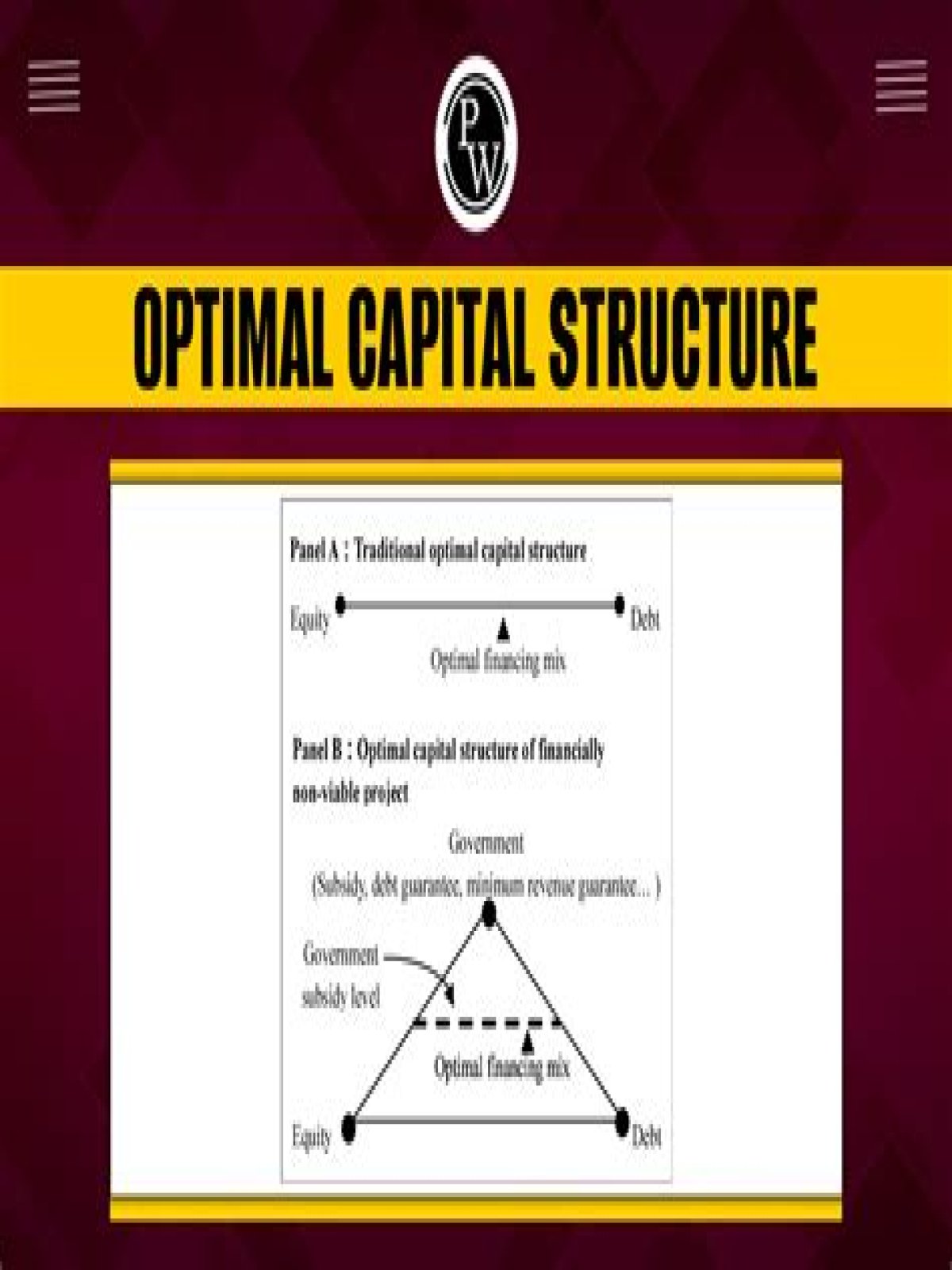

The optimal capital structure is estimated by calculating the mix of debt and equity that minimizes the weighted average cost of capital (WACC) of a company while maximizing its market value. The lower the cost of capital, the greater the present value of the firm’s future cash flows, discounted by the WACC.

How optimum capital structure has an impact on the valuation of a firm?

So, as the level of debt increases, returns to equity owners also increase — enhancing the company’s value. So, the optimal capital structure comprises a sufficient level of debt to maximize investor returns without incurring excessive risk. Identifying the optimal structure is a combination of art and science.

How do you calculate a company’s capital structure?

It is calculated by dividing total liabilities by total equity. Savvy companies have learned to incorporate both debt and equity into their corporate strategies.

What do you mean by capital structure when should it be called Optimum?

The optimal capital structure of a company refers to the proportion in which it structures its equity and debt. It is designed to maintain the perfect balance between maximising the wealth and worth of the company and minimising its cost of capital. The WACC is the weighted average of its cost of equity and debt.

Which of the following is irrelevant for optimal capital structure?

Solution(By Examveda Team) Flexibility is not a feature of an optimal capital structure. An optimal capital structure is the objectively best mix of debt, preferred stock, and common stock that maximizes a company’s market value while minimizing its cost of capital.

What are the factors that influence optimal capital structure?

Capital Structure: 10 Factors Influencing Capital Structure – Explained!

- Financial Leverage or Trading on Equity:

- Expected Cash Flows:

- Stability of Sales:

- Control over the Company:

- Flexibility of Financial Structure:

- Cost of Floating the Capital:

- Period of Financing:

- Market Conditions:

What is the relationship between capital structure and firm value?

The capital structure decision is significant as its affects the costs of the capital and the market value of the firm. A firm that has no debt in its capital structure is referred to as unlevered firm, whereas a firm that has debt in its capital structure is referred as levered firm.

How does the capital structure of a firm affect the WACC?

Assuming that the cost of debt is not equal to the cost of equity capital, the WACC is altered by a change in capital structure. The cost of equity is typically higher than the cost of debt, so increasing equity financing usually increases WACC.

Why does capital structure not matter?

According to a Modigliani and Miller (1958 article), if there are no corporate taxes, the mix of debt and equity does not matter and does not have any impact on the value of the firm. The value of the firm is simply equal to the operating income divided by the overall cost of capital.

What are the determinants of capital structure?

The determinants of capital structure are firm characteristics such as growth, firm size, collateral value of assets, profitability, volatility, non-debt tax shields, uniqueness, industry, etc. Each determinant of capital structure may have several indicators.

What is the importance of capital structure?

Importance of Capital Structure It prevents over or under capitalisation. It helps the company in increasing its profits in the form of higher returns to stakeholders. A proper capital structure helps in maximising shareholder’s capital while minimising the overall cost of the capital.

What are the factors that affect capital structure?

The various factors which influence the decision of capital structure are:

- Cash Flow Position:

- Interest Coverage Ratio (ICR):

- Debt Service Coverage Ratio (DSCR):

- Return on Investment:

- Cost of Debt:

- Tax Rate:

- Cost of Equity:

- Floatation Costs:

What should be the optimal capital structure for a company?

Their revised work, universally known as the Trade-off Theory of capital structure, makes the case that a company’s optimal capital structure should be the prudent balance between the tax benefits that are associated with the use of debt capital, and the costs associated with the potential for bankruptcy for the company.

Is it possible to increase shareholder wealth by changing the capital structure?

Is it possible to increase shareholder wealth by changing the capital structure? The first question to address is what is meant by capital structure. The capital structure of a company refers to the mixture of equity and debt finance used by the company to finance its assets.

How does bankruptcy affect the capital structure of a company?

While it is a last resort, bankruptcy can give companies a fresh start. Bankruptcy usually happens when a company has far more debt than it does equity. While debt in a company’s capital structure may be a good way to finance its operations, it does come with risks.

Why are debt and equity the best capital structures?

Companies use debt and equity achieve an optimal capital structure and finance their operations. Those that finance themselves with debt are seen as more valuable because they can use interest to decrease their tax liabilities. But taking on too much debt can increase the level of risk to shareholders, as well as the risk of bankruptcy.

Which is the best way to calculate the optimal capital structure?

The optimal capital structure is estimated by calculating the mix of debt and equity that minimizes the weighted average cost of capital (WACC) of a company while maximizing its market value. The lower the cost of capital, the greater the present value of the firm’s future cash flows, discounted by the WACC.

Why is optimization of capital structure an important decision?

The prime objective while deciding about the optimal capital structure of a firm is to maximize the value of the company. The business firm, while raising funds for financing its investment proposals, has to make a choice from amongst different sources in different proportions. These can be the following:

How does dividends affect the capital structure of a company?

To add more, many companies pay dividends which decrease retained earnings and increase the amount of funding company must have to finance its business. So factors affecting capital structure decision of a firm are interrelated with dividend policy.

Is it possible to increase shareholder wealth by changing the capital structure? The first question to address is what is meant by capital structure. The capital structure of a company refers to the mixture of equity and debt finance used by the company to finance its assets.