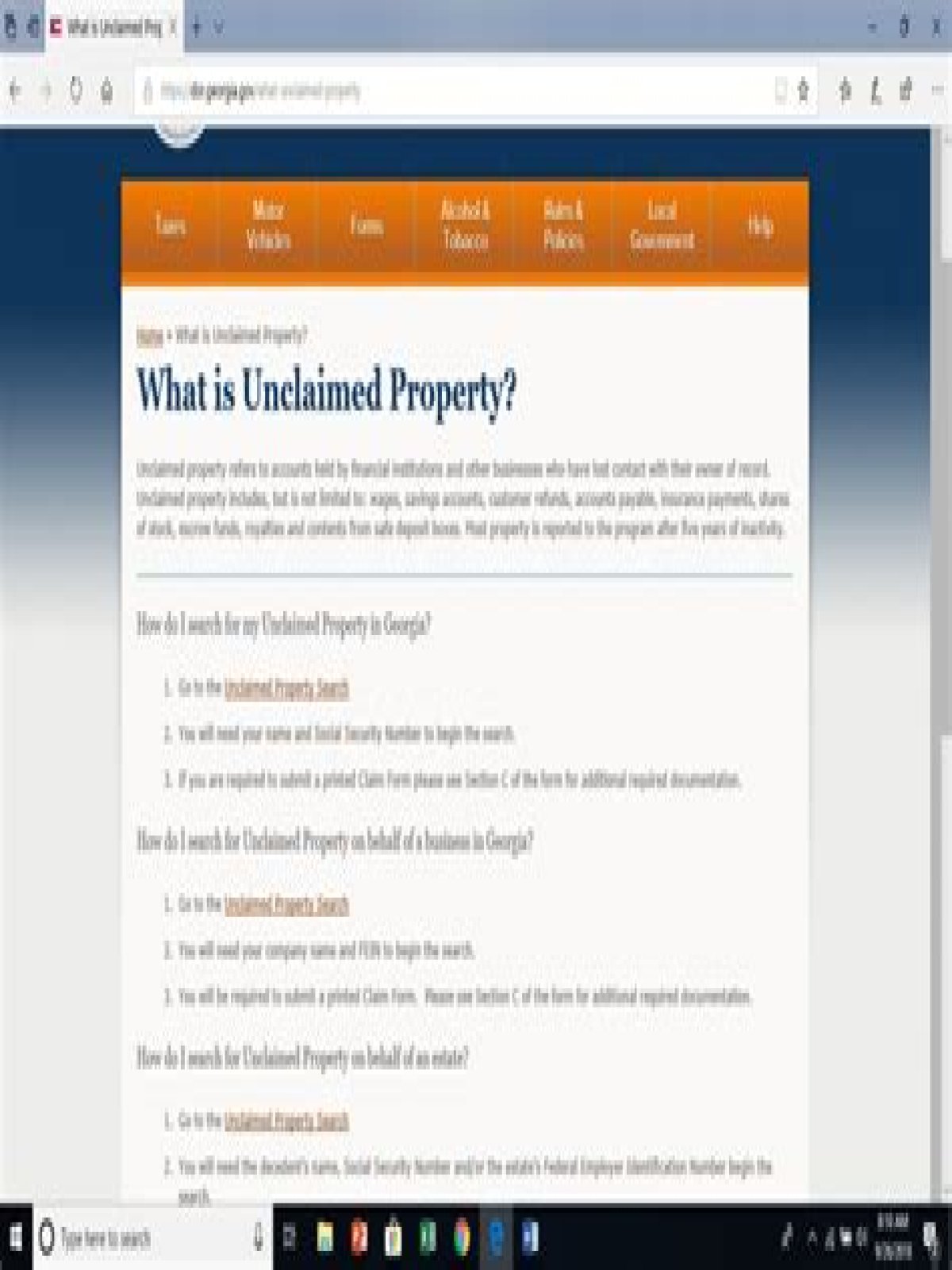

How do I search for my Unclaimed Property in Georgia? Go to the Unclaimed Property Search.You will need your name and Social Security Number to begin the search.If you are required to submit a printed Claim Form please see Section C of the form for additional required documentation.

How do you buy unclaimed property in Georgia?

Go you to the Georgia Department of Revenue’s unclaimed property database and search for property with your last name or business name, first name, and city. You can also purchase a complete list of unclaimed property from the state. It is published in July of each year.

What is the dormancy period for unclaimed property in Georgia?

Georgia Dormancy Periods

Generally, most property types have a 5-year dormancy period. Accounts are considered dormant if the property owner has not indicated any interest in the property, or if no contact has been made by the owner for the allotted dormancy period for that property.

What happens when you claim unclaimed property?

States have established processes whereby legal owners of assets can reclaim unclaimed funds. When claiming unclaimed funds that have risen in value, taxes may be assessed at the time. If you claim property, it will be treated as ordinary income and taxed accordingly unless the property is related to a tax refund.

Where is my money Ga?

To check the status of your Georgia state refund online, go to Then, click on the “Where’s My Refund?” button. After that, you will be prompted to enter: Your Social security number or ITIN.

How do you transfer ownership of an abandoned house in Georgia?

To be eligible, the person acquiring the property must do so publicly and pay property taxes or otherwise act as though he or she already has the right to possess it. Georgia adverse possession laws require 20 years of occupation in order to claim title.

Is unclaimed org legit?

The National Association of Unclaimed Property Administrators’ website is an excellent resource. This association consists of state officials charged with the responsibility of reuniting lost owners with their unclaimed property.

What is the dormancy period for unclaimed property in Hawaii?

Dormancy periods range from one year to fifteen years. notice, informing the owner that the holder will escheat the property to the State of Hawaii. Holders must report property determined to be unclaimed for owners with a last known address in Hawaii.

How long does it take to get your money from Indiana unclaimed?

The Clerk’s Office will mail you the Unclaimed Funds Inquiries form, or you can download the form . Submit your completed form to the Clerk’s Office. The Clerk’s Office will research your claim and process accordingly. The process should be completed within 90 days.

What do you do with uncashed paychecks in Georgia?

If you are a corporation and have identified uncashed payroll checks dated 7/1/16 – 6/30/17, you should report them as unclaimed property for the reporting period 7/1/17 – 6/30/18. You should attempt to notify the payee of the check at the last known address between 7/1/18 and 9/1/18.

How do I claim unclaimed money in Florida?

You can claim the money on your own, directly with our office, free of charge. Click here to search our database and print a claim form for any account(s) you believe you are entitled to claim. The unclaimed property program is a free service provided to you by the State of Florida.

What happens to unclaimed fixed deposit?

The RBI has now tweaked rules for interest rates on unclaimed fixed deposits (FD), wherein if depositors forget to claim the proceeds after maturity, the amount left unclaimed will attract interest rate applicable to savings account or contracted rate whichever is lower.

What is unclaimed deposit?

Unclaimed deposits are deposits where the proceeds/maturity amount has not been claimed for a period of 10 years or more. In other words,term deposits are deemed unclaimed if they are inactive/inoperative for more than 10 years. The same holds good for accounts too.