- Is a wrap-around mortgage legal?

- What is the main advantage of a wraparound mortgage?

- Who is usually the seller in a wraparound loan?

- What is the difference between purchase money mortgage and wrap-around mortgage?

- Who is responsible for the underlying loans when a wraparound is created?

- What is the major feature of a wraparound loan?

- Why is RESPA important?

- Is a wrap-around mortgage legal in Texas?

- What does wraparound mean?

- What is a SAM loan?

- What is a wrap-around agreement?

- What is an example of a buydown?

- Can a seller take back a first mortgage?

- How do you tell if a mortgage is a purchase money mortgage?

- What is Regulation Z?

- What would discourage a buyer from taking a bank wraparound mortgage?

- What is a Wally wrap?

- What is the collateral in a blanket mortgage?

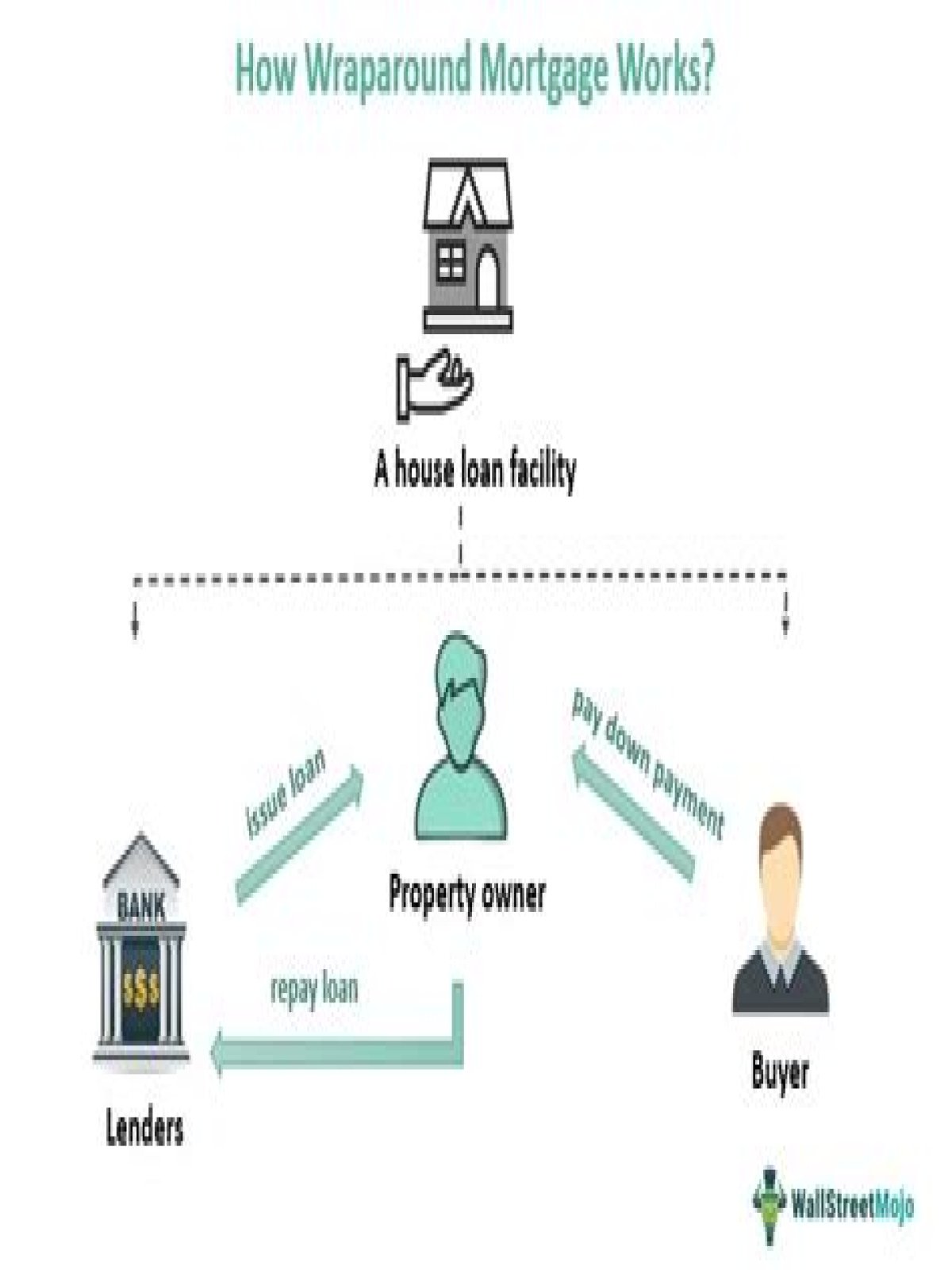

In a wrap-around mortgage situation, the buyer gets their mortgage from the seller, who wraps it into their existing mortgage on the home. The buyer becomes the owner of the home and makes their mortgage payment, with interest, to the seller.

Is a wrap-around mortgage legal?

Are Wraparound Mortgages Legal? Wraparound mortgages are generally considered to be legal. However, they are less commonly used in the real estate market due to several factors. One of these considerable factors is the increased inclusion of “due on sale” clauses in many mortgage agreements.

What is the main advantage of a wraparound mortgage?

The main benefit of a wraparound mortgage is the ability for an investor to purchase property, even if they have poor credit.

Who is usually the seller in a wraparound loan?

Usually, but not always, the lender is the seller. A wrap-around is one type of seller-financing. The alternative type of home-seller financing is a second mortgage.

What is the difference between purchase money mortgage and wrap-around mortgage?

Similar to a purchase-money mortgage, a wrap-around mortgage is another means for buyers who can’t qualify for a home loan to purchase a home from a seller. The seller still finances the buyer’s home purchase, but keeps the existing mortgage on the home and “wraps” the buyer’s loan into it.

Who is responsible for the underlying loans when a wraparound is created?

Under a wrap, a seller accepts a secured promissory note from the buyer for the amount due on the underlying mortgage plus an amount up to the remaining purchase money balance. The new purchaser makes monthly payments to the seller, who is then responsible for making the payments to the underlying mortgagee(s).

What is the major feature of a wraparound loan?

A wraparound mortgage is an arrangement where seller financing acts as a junior loan that wraps around the original loan. One unique feature about this type of mortgage is that while the seller is no longer listed as an owner of the home, they do remain on the original mortgage.

Why is RESPA important?

Why is RESPA important? It informs buyers about their specific closing costs. What law says that borrowers must receive a good faith estimate of the closing costs within three business days of the loan application? the buyer will receive a debit and the seller will receive a credit.

Is a wrap-around mortgage legal in Texas?

So-called “wrap loans” are legal in Texas. When done legitimately, a home is sold with an existing lien still on it. The buyer uses a wrap lender to take out a second, higher-interest loan that “wraps” around the existing one.

What does wraparound mean?

wraparound. noun. Definition of wraparound (Entry 2 of 2) 1 : a garment (such as a dress) made with a full-length opening and adjusted to the figure by wrapping around. 2 : an object that encircles or especially curves and laps over another.

What is a SAM loan?

A shared appreciation mortgage, or SAM, is a home loan in which the lender offers a below-market interest rate in exchange for a share of the profit when the house is sold. A SAM usually has a deadline for paying off the principal, for example, 10 years.

What is a wrap-around agreement?

As the term implies, a wrap-around contract is a type of financing where the seller carries back a private note that wraps around the existing mortgage on the home. I’m willing to take a $30,000 down payment with the balance of the purchase price to be financed on a $270,000 private contract using a wrap-around note.

What is an example of a buydown?

For example, a mortgage lender may offer a borrower the ability to reduce their interest rate by . 25% in exchange for a point. So, if the borrower is obtaining a mortgage for $400,000 and is offered an interest rate of 4%, paying $4,000 would lower their interest rate to 3.75%.

Can a seller take back a first mortgage?

The vendor take back mortgage allows the seller of the home to lend money to the buyer for the purchase of their own property. The property has to be owned outright by the seller, meaning there can’t be a mortgage on the home at the time of selling.

How do you tell if a mortgage is a purchase money mortgage?

This is called a purchase money mortgage, because this type of mortgage usually replaces part or all of the cash that the buyer would otherwise pay the seller. For example, a buyer might pay for a $500,000 house with a $400,000 bank mortgage, $60,000 in cash, and a $40,000 purchase money mortgage.

What is Regulation Z?

Regulation Z prohibits certain practices relating to payments made to compensate mortgage brokers and other loan originators. The goal of the amendments is to protect consumers in the mortgage market from unfair practices involving compensation paid to loan originators.

What would discourage a buyer from taking a bank wraparound mortgage?

What would discourage a buyer from taking a bank wraparound mortgage? The vendor has elected to foreclose an agreement for sale as a mortgage.

What is a Wally wrap?

Wally Wrap – How It Works. Under Wally Wraps, an existing seller’s loan(s) are not assumed by the buyer, but a seller financed loan is stacked on the Prior Note(s). The Seller remains fully obligated for payments under the Prior Note(s) and no relationship is established between the buyer and seller lenders.

What is the collateral in a blanket mortgage?

A blanket mortgage is a single mortgage that covers two or more pieces of real estate. The real estate is held together as collateral, but the individual properties may be sold without retiring the entire mortgage. Blanket mortgages are commonly used by developers, real estate investors, and flippers.