- What circumstances is a perpetual inventory system preferred?

- What are some product examples that would use a perpetual inventory system?

- Why is it important to periodically take a physical inventory if the perpetual system is used?

- Why is a perpetual inventory system important?

- Who uses periodic inventory system?

- When the perpetual inventory system is used the inventory sold is debited to quizlet?

- When the perpetual inventory system is used the cost of sales is?

- What is the major advantage of using a perpetual inventory system quizlet?

- How do you record a perpetual inventory system?

- Why is perpetual inventory procedure being used increasingly in business?

- How do you use the periodic inventory system?

Businesses with high sales volume and multiple retail outlets (like grocery stores or pharmacies) need perpetual inventory systems. The technological aspect of the perpetual inventory system has many advantages such as the ability to more easily identify inventory-related errors.

What circumstances is a perpetual inventory system preferred?

Advantages of the Perpetual Inventory System

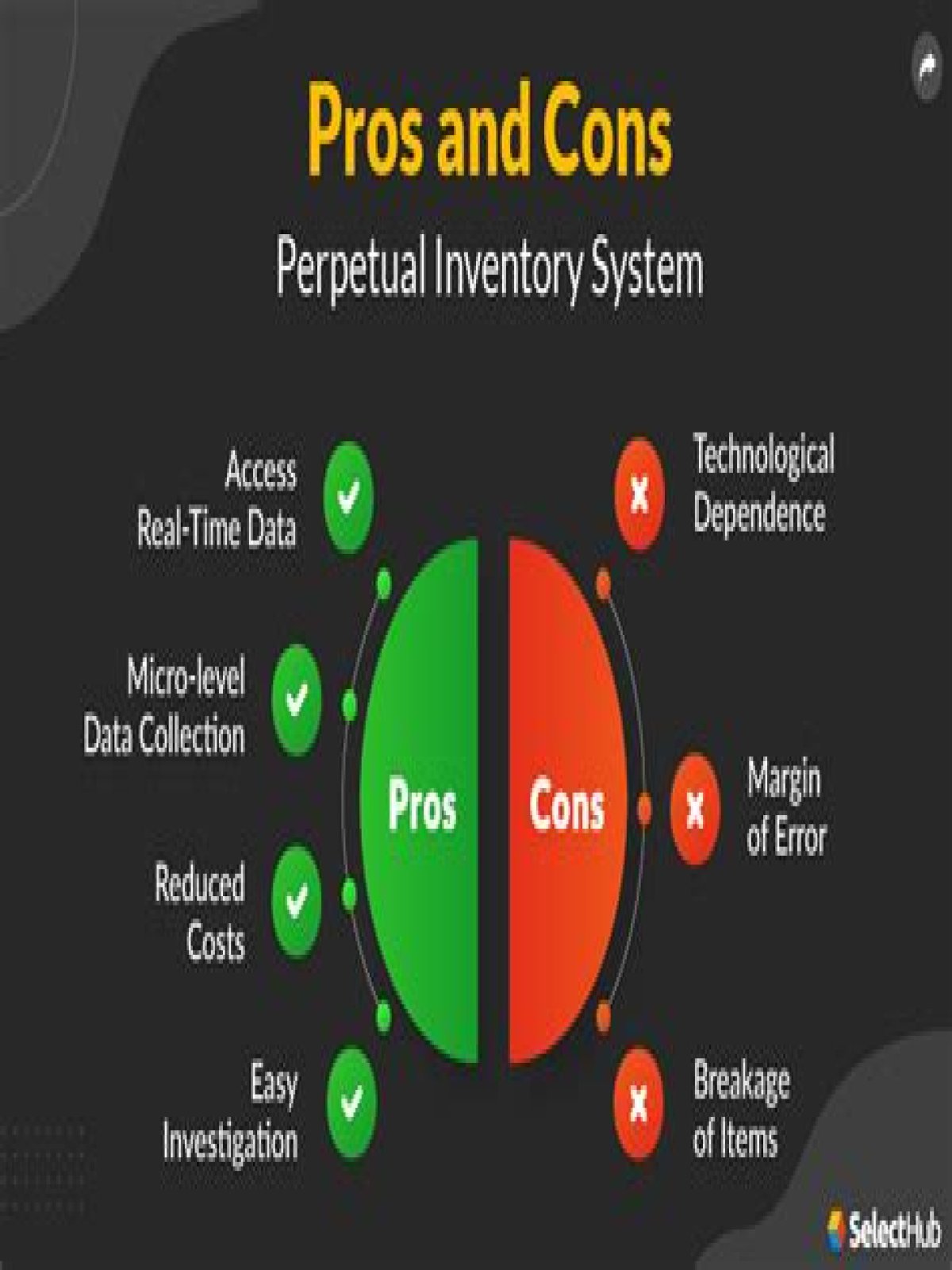

While errors in inventory occur due to loss, breakage, theft, improper inventory tracking, or scanning errors, there are many advantages to using a perpetual inventory system: Prevents stock outs; a stock out means that a product is out of stock.

What are some product examples that would use a perpetual inventory system?

For example, a grocery store may use a perpetual inventory system. Each time a product is scanned and purchased, the system updates the inventory levels in a database.

Why is it important to periodically take a physical inventory if the perpetual system is used?

Why is it important to periodically take a physical inventory when using a perpetual inventory system? It should be taken periodically to test the accuracy of the perpetual records. In addition, a physical inventory will identify inventory shortages or shrinkage.

Why is a perpetual inventory system important?

A perpetual inventory system is superior to the older periodic inventory system because it allows for immediate tracking of sales and inventory levels for individual items, which helps to prevent stockouts.

Who uses periodic inventory system?

A periodic inventory system is best suited for smaller businesses that don’t keep too much stock in their inventory. For such businesses, it’s easy to perform a physical inventory count. It’s also far simpler to estimate the cost of goods sold over designated periods of time.

When the perpetual inventory system is used the inventory sold is debited to quizlet?

Under the perpetual inventory system, a company purchases merchandise on terms 2/10, n/30. The entry to record the purchase will include a debit to Cash and a credit to Sales. If the perpetual inventory system is used, the merchandise inventory account is debited for purchases of merchandise.

When the perpetual inventory system is used the cost of sales is?

The perpetual inventory system controls inventory in order to both protect it from theft and damage and report it in the balance sheet as an asset that impacts net income. When the inventory is sold to customers, the inventory asset becomes an expense called cost of goods sold.

What is the major advantage of using a perpetual inventory system quizlet?

The major advantage of the perpetual system is the inventory account will reflect changes to inventory on a continual basis. Another advantage of the perpetual method is that it allows for better internal control of inventory. A physical inventory should be taken even when the perpetual method is used.

How do you record a perpetual inventory system?

Perpetual Inventory System Journal Entries Inventory Purchase: Under perpetual inventory system, a purchase is recorded by debiting inventory account and crediting accounts payable assuming that the purchase is on credit. Purchase Discount: Purchase Return: Inventory Sale: Sales Return:

Why is perpetual inventory procedure being used increasingly in business?

Most small businesses still use periodic inventory management, although perpetual inventory management has become increasingly popular due to the development of more sophisticated computer scanning of inventory, lower software costs, and increased software functionality.

How do you use the periodic inventory system?

Periodic inventory is an accounting stock valuation practice that’s performed at specified intervals. Businesses physically count their products at the end of the period and use the information to balance their general ledger. Companies then apply the balance to the beginning of the new period.